TRESP CORPORATE SERVICES

Tresp Corporate Services, LLC provides incorporation and corporate compliance services in Wyoming and California.

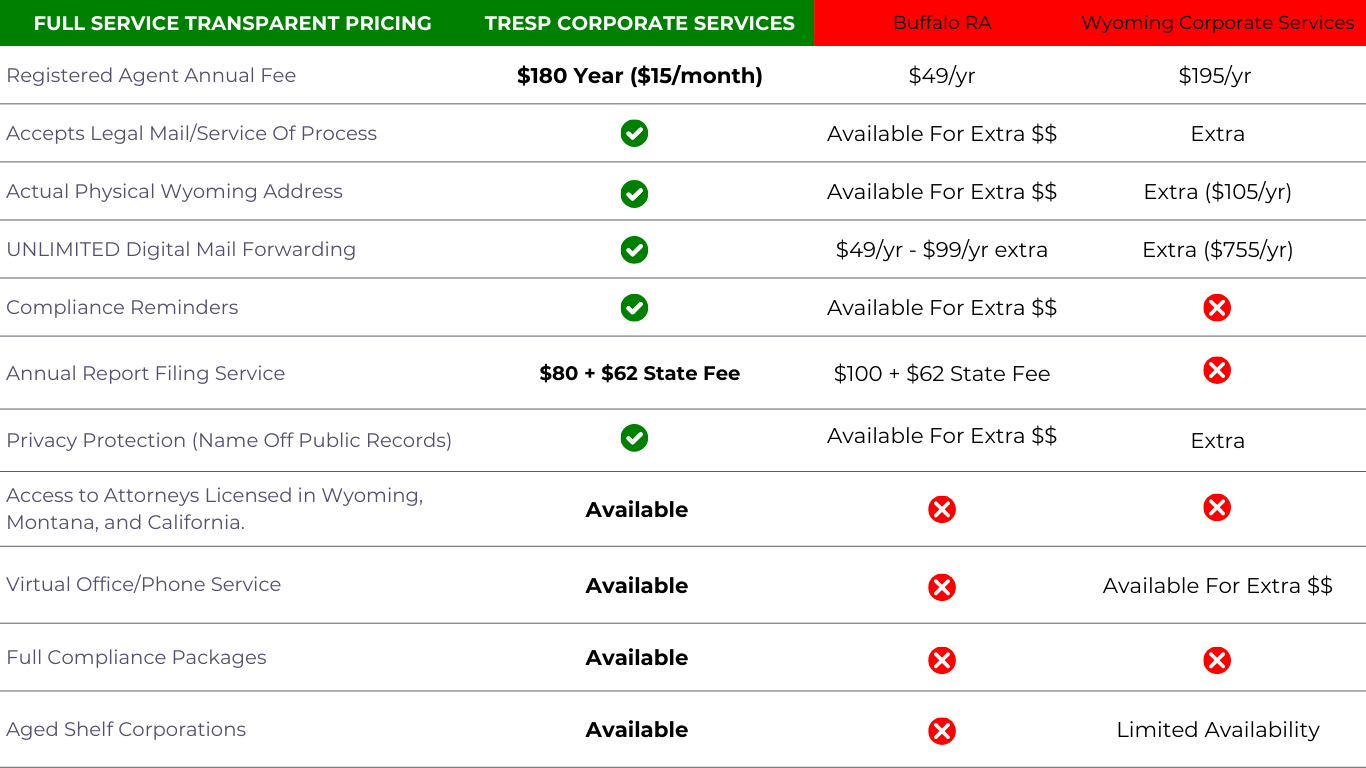

We have numerous aged shelf corporations and LLCs; and we provide attentive white-glove registered agent services, address services, mail forwarding, phone services, privacy services, nominee services, CPA packages, and attorney privacy packages.

821 S Main St

Kemmerer, WY 83101

Incorporate In Wyoming

Enjoy perks like no corporate tax, personal income tax, or franchise tax. Benefit from low fees, no share certificates required, and real privacy protection. Simplify your business journey with Tresp Corporate Services.

Corporate Compliance Program

Navigating the intricate landscape of regulations can be complex, and that's where our expertise comes into play.

Asset Protection

Secure your wealth with TCS’s comprehensive asset protection solutions. Our tailored strategies shield your assets from potential risks, ensuring peace of mind and financial security for you and your loved ones.

Incorporate in Wyoming

Our 120 year-old fully-renovated 4,000 square foot office in the heart of Kemmerer, Wyoming, directly across from the original JC Penney mother store.

No corporate tax

No personal income tax

No franchise tax

Low annual fees

No share certificates required

Minimal filing fees

No business license fees

No initial list after filing

No business license fees

No department of revenue for taxes

No listing of your members or managers with the Secretary of State

No Name-Based Searchable Database

Real, legally protected privacy and asset protection

Tresp Corporate Services is eager to provide you with the care that you deserve. Learn more about how we can do that.

-

Wyoming does not require the manager nor the members of a Wyoming LLC to be listed on a public database. Nevada requires a tax ID number of the company and a personal guarantee by you on the state’s business license.

-

If you have a Wyoming LLC, you can operate your Corporation and live anywhere in the world; you do not have to be a US citizen to incorporate in Wyoming. But, in order to give substance to your operation, you should know about our Office Service Contract and learn how the use of this inexpensive option will give “presence” to your remote corporate operations. And, if you are not a US Citizen, we have a section for you to read here.

-

Among the many other advantages of incorporation here, there are no State taxes for Wyoming LLCs. If you choose to incorporate in Wyoming, your company may not pay State taxes at all. Stop for a minute and think about what you paid last year in your state’s income tax.

According to the new 2022 edition of the Tax Foundation’s State Business Tax Climate Index, “Wyoming has the most business-friendly tax system of any state,” for the tenth year in a row.